Blockchain-Based Identity Verification in Banking: A Game-Changer

- Team IBDIC

- Nov 23, 2023

- 3 min read

One of the major problems of the fast-paced world is the use of manual verification identity in various banking sectors, which causes huge disadvantages to people and users. Before blockchain, banks faced multiple challenges with manual identity verification, which led to loss of information, authenticity and security.

According to a report by Grand View Research, the global identity verification market size is expected to expand at a CAGR of 16.7% from 2022 to 2030.

Fast forward to today, the banking industry is adopting innovative technologies to ease up the banking experience and offer more convenience to its customers through online banking, identification and much more. One such technology is blockchain. Let’s get to the business and discuss how blockchain is revolutionizing identity verification in the realm of banking.

First of all, what’s identity verification when it comes to banking? Well, it is a process of verifying an individual’s identity with the information provided by the customers. along with the approved documents or proof of ID. It is done to verify the provided information is matching with the documents. For instance, opening a bank account or applying for a loan.

Primary Challenges in the Traditional Way of Identity Verification

Time-consuming

Bad user experience

Errors made subject to human

Authenticity

Loss of information

Fusing Blockchain to Ease Up Banking Services

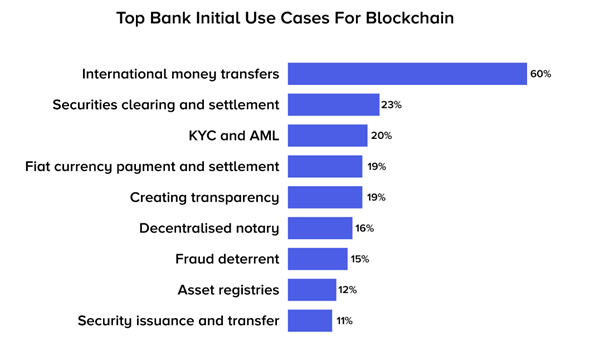

Blockchain in banking plays a crucial role by making the transactions recorded in real-time, immutable, fast, and cost-efficient. It also makes the work of the customers easy instead of waiting for a whole day just to verify their identity. The main reason why banks are adopting blockchain is it acts as a main player, where the transactions are tracked, and it is transparent to the public. It also helps in fast process and smart contract benefits. The banking sector is the most significant planned and current adopter of blockchain technology among financial markets at 53%, followed by the insurance industry at 33%.

Source: EFMA & Deloitte

Blockchain-based Identity Verification: Secure, Reliable and Cost-Effective

It is a verification process of the identity of an individual with the help of blockchain technology, where the information stored or verified cannot be lost or changed. It provides enhanced security to the information collected. Quick digest: The digital identity verification market is projected to reach $12.8 billion by 2024, even though digital IDs are still largely underused today.

In the age of rapidly evolving digital landscapes, blockchain acts as a powerful solution in identity verification. With its inherent features of transparency, security and immutability, it enhances and facilitates speedy identification and verification of banking customers.

The banks can ensure the data is stored and authenticated. In addition to this, it also helps in the reduction of paperwork and time-saving.

It simplifies the usage of KYC and AML processes by using the ledger in which stored data cannot be erased.

Banks can create secure and reliable identities, which reduces the manual identity verification process.

It also reduces the cost associated with the services the banks provide by using the decentralised ledger technology.

It helps the quick and reliable verification process and makes the customer experience more convenient.

According to a report by Juniper Research, the number of digital identity apps using blockchain technology will grow from 11 million in 2017 to over 200 million in 2024, with the banking sector accounting for over 40% of the deployments.

Exploring a Few Blockchain-Based Identity Verification Case Studies

Tradle offers a blockchain-based KYC platform at lower costs and relatively at high speed across the insurance and banking sectors. Tradle uses the blockchain to store proof of verification data. It gives complete ownership to the respective individual and helps them to share their data across business lines without causing any trouble.

Another case study to consider could be ID2020, a project aimed at creating digital identities for people who don’t have paper ID proof. In addition to this, the project is supported by Microsoft and Accenture.

Conclusion

Overall, the blockchain-based use of identity verification helps the users and the banking sector to bring numerous benefits. It also builds trust in the customers and the accurate data, which is immutable. It also makes the work easier for the users and the industry in various other use cases.

In this section you can find useful information about bookmakers specializing in football betting https://sportskhabri.com/football-betting-sites/ . The key features of each platform are described, withdrawal options and support service work are indicated. The materials are structured and help to quickly navigate the variety of offers.